Support for business (and employees) with JobKeeper: an overview and some insights

On 30 March 2020, the Federal Government announced the creation of a new JobKeeper scheme. Eventually, we saw the detail, with the legislation being introduced to, and swiftly passed by, the Australian Parliament, shortly followed by the Treasurer making the Rules accompanying the scheme, all on 9 April 2020.[1]

Critically, and subject to some twists, the scheme is primarily intended to provide financial assistance to businesses to retain staff (rather than make them redundant) during the current economic downturn caused by the COVID-19 pandemic and the government measures that have been put in place to slow its spread within Australia. That key support is in the form of a wage subsidy.

While JobKeeper is primarily a wage subsidy for business, as opposed to JobSeeker (which is a social benefit payment to the unemployed), it is also meant to be an economic stimulus (or sustenance) package as well. This explains some features of the scheme.

The scheme is also supported by other measures, as we discuss below. It is hoped with workplace co-operation and social isolation, businesses and employment will survive and remain to help Australia in the recovery phase.

What is involved in the JobKeeper scheme?

The scheme has two parts to it:

-

The much-publicised $1,500 (gross) per fortnight JobKeeper payment made to qualifying employers (for the benefit of eligible employees); and

-

Changes to the Fair Work Act 2009 (Cth) (FW Act) to increase flexibility in retaining employees.

Let’s examine each in detail:

JobKeeper payments

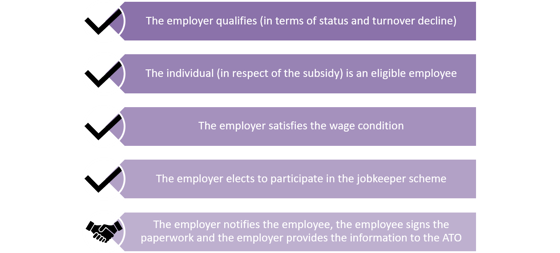

Diagram: The entitlement to a JobKeeper payment (for an individual employee):

The ability to access JobKeeper payments is dependent on a number of matters as illustrated in the above diagram.

One of the key requirements is that the business must be a qualifying employer.

What is a qualifying employer?

A qualifying employer must carry on business in Australia, or a non-profit body pursuing its objectives in Australia, and otherwise not excluded from the scheme, and have an actual or projected decrease in turnover as follows:

-

For businesses with an aggregated turnover of $1 billion or more – a 50% decline in GST turnover compared to the same month in the last year;

-

For ACNC-registered charities (with some education-based exemptions) – a 15% decline in GST turnover compared to the same month in the last year; or

-

For all other businesses – a 30% decline in GST turnover compared to the same month in the last year.

What is an eligible employee?

Once the employer is a qualifying employer, it is entitled to access the JobKeeper payment for each and every eligible employee. An employee is an eligible employee provided that the employee:

-

Was employed by a qualifying employer on 1 March 2020, and is currently employed (including those stood down or re-hired);

-

As at 1 March 2020, was in permanent employment or a casual employee employed on a regular or systematic basis during the period of 12 months ending 1 March 2020;

-

Completes and returns a nomination notice form (here);

-

Was at least 16 years of age as at 1 March 2020;

-

As at 1 March 2020, was residing in Australia and an Australian citizen or permanent resident; or an Australian resident for income tax purposes and a Subclass 444 (Special Category) visa holder;

-

Is not currently receiving parental leave pay or dad and partner pay; and

-

Is not currently totally incapacitated for work and receiving payments under an Australian workers’ compensation law in respect of your total incapacity to work.

Completing the paperwork to get the payment

Access to the JobKeeper scheme is not automatic. Businesses planning to access the provisions need to register with the Australian Taxation Office (see here). Registrations are scheduled to open on 20 April 2020.

Once a business has registered and provided information about the eligible employees claimed, it will need to provide a monthly record of its current turnover for the reporting month and its projected turnover for the following month.

Businesses must also keep records of the payments made to eligible employees.

As is apparent from the above, a qualifying employer needs to notify employees that it is applying to the ATO for the payment and make that application in the approved form.

Who gets the JobKeeper payment?

Subject to an important understanding below, the $1,500 a fortnight payment is a wage subsidy for the business to assist it to cover the wages of its employees.

Once an employer is a qualifying employer, the JobKeeper payment applies in relation to each eligible employee. It is not necessary for employees to be subject to a JobKeeper direction (discussed below).

The payment is made to the qualifying employer for each fortnight they qualify and will be made in arrears (starting from May 2020, for each fortnight from 30 March 2020).

The basis on which the payment is made is as follows: the employer must pay the employee their full or agreed wage for the work performed (ensuring compliance with minimum wage obligations), and if that amount:

-

Is greater than the $1,500 subsidy, then the JobKeeper payment is kept by the employer as a subsidy towards the payment of the employee’s wage; or

-

Is less than the $1,500 subsidy, the employer must pay the employee $1,500, even if they are not working (because they are stood down) or it results in a temporary pay increase for the employee.

Importantly, the Explanatory Statement to the Rules anticipate that a qualifying employer may re-hire an employee terminated after 1 March 2020, so that the employee can obtain the JobKeeper benefit (and retain employment).

Changes to the Fair Work Act

The second feature to the JobKeeper scheme involves temporary amendments to the FW Act – for a limited period of six months – to provide greater flexibility to qualifying employers in managing staff in response to the pandemic.

An important condition of this feature is the obligation to: ensure the employee is paid at least the JobKeeper payment, is paid at their normal or agreed rate for all work performed and that they are always paid equal to or above their minimum base rate of pay (established under award, enterprise agreement or national minimum wage order).

There are two main elements to the FW Act amendments:

-

Directions in relation to stand down (including reduction in days and hours of work, including to nil hours), change of duties and location of work (“JobKeeper enabling directions”); and

-

The ability for employers to make a request for eligible employees (which cannot be unreasonably refused) to reach an agreement to:

-

vary working hours, days (to different days and times, as opposed to reducing the number of hours of work); and

-

taking of annual leave (at full pay, provided a two-week balance remains).

-

The JobKeeper enabling directions have been introduced in recognition of the limited compass of the existing stand down provisions under s 524 of the FW Act.

JobKeeper enabling stand down directions

Where the employee cannot be usefully employed for the employee’s normal days or hours as a consequence of COVID-19, the qualifying employer may direct the eligible employee to:

-

Not work on a day or days on which the employee would usually work; or

-

Work for a lesser period than the period which the employee would ordinarily work on a particular day or days; or

-

Work a reduced number of hours (compared with the employee’s ordinary hours of work).

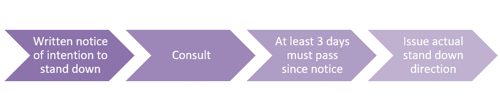

Diagram: Process for issuing JobKeeper enabling stand down direction

The employer is required to consult in relation to the JobKeeper enabling direction and provide the employee with at least three days’ written notice before issuing any actual stand down direction. Furthermore, a JobKeeper enabling direction does not apply if it is unreasonable in all the circumstances.

Penalties

Businesses who misuse the JobKeeper enabling directions may be fined up to $126,000. Failure to meet the minimum salary obligations may result in a fine of up to $12,600.

Any disputes arising under the scheme will be resolved by the Fair Work Commission.

Once the JobKeeper scheme ends, businesses are not currently required to retain eligible employees.

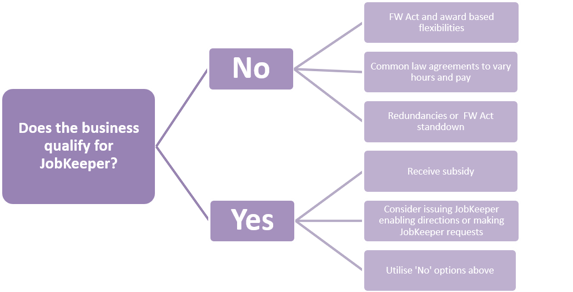

What if your business does not qualify?

If the business does not qualify for JobKeeper, other options are available as discussed in our previous bulletins.

Diagram: The options for business in managing labour and labour costs

Business should keep a close eye on its revenue and any decline, and consider when it is eligible to apply for JobKeeper.

Questions?

We know that there are a lot of questions and uncertainty about how to best respond to the COVID-19 pandemic and the resulting economic downturn. The JobKeeper scheme will hopefully provide some assistance to businesses as we make our way through these crazy times. Details of the scheme are still emerging. A useful source of up-to-date information is the Fair Work Ombudsman website (here).

If you have any questions about the JobKeeper scheme or any other aspect of your COVID-19 response, feel free to reach out and give us a call.

Authors: James Mattson, Amber Sharp and Jade Bond

See also short video related to this article: JobKeeper Directions and Consultation

[1] Coronavirus Economic Response Package (Payments and Benefits) Act 2020 (Cth), the Coronavirus Economic Response Package Omnibus (Measures No. 2) Act 2020 (Cth) and the Coronavirus Economic Response Package (Payments and Benefits) Rules 2020 (Cth).