Indefeasibility of title - legal certainty in an age of rising fraud

Recently, we explored the emerging forms of AI-enabled frauds affecting the banking and financial sector and key considerations for lenders. You can read that article here: Fraud Risks in Lending: Detection and Prevention

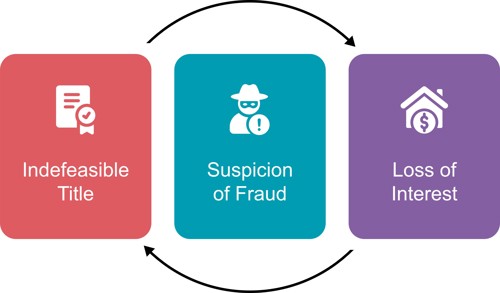

A serious legal consequence emerging from the impact of fraud is challenges lenders face to their otherwise indefeasible title. While lenders often assume that once their mortgage is registered their position is secure, the reality is that certain categories of fraud can displace that protection, extinguish priority and diminish prospects of recovery.

In this article, we explore the principle of indefeasibility with a particular focus on fraud as a key exception and what this means for enforceability as a secured lender. We also outline practical risk management strategies for lenders to mitigate their exposure to, or involvement in, fraudulent conduct.

Principle of Indefeasibility

Indefeasibility of title is an important principle in property law that establishes priority and ownership of property even when there are competing claims. For lenders, this principle typically provides assurance that their registered mortgage is protected. There are some notable exceptions to the principle of indefeasibility and key amongst them is fraud.

Australia operates under two primary systems of land registration:

-

Torrens Title; and

-

Old System Title.

Prior to the introduction of the Torrens Title system, Old System Title was the method of proving land ownership where the first mortgagee took a conveyance of the security and became the legal owner of it. Old System Title requires an analysis of the available evidence of ownership of the land in question in order to prove legitimacy of ownership. By contrast, the Torrens System provides ownership by registration.

The Torrens Title system is now mandatory in all Australian states for registering land ownership. A key feature of the Torrens Title system is its reliance on the principle of indefeasibility of title. This means that once an interest is registered pursuant to the Real Property Act 1900 (NSW), it is protected against competing claims, giving it legal priority.

In this regard, the Australian courts have adopted the approach of 'immediate indefeasibility'. This means that an interest is immediately registered on title regardless of any invalidity or defect in the registered instrument, protecting that interest immediately from later competing claims. Hence, the strength of indefeasibility of title if registration can be achieved.

Exceptions to Indefeasibility

While the principle of indefeasibility generally protects registered interests from challenge by later registered interests, there are limited exceptions where a court may set aside a registration.

The exceptions which provide for a registered interest to be defeated by later registered interests are:

|

Exception |

Summary |

|

Fraud |

Dishonest conduct to obtain registration, including fraud by an agent. |

|

Forgery |

Registration based on a forged document or signature. |

|

Misdescription |

Significant errors in describing the property or interest sufficient to invalidate title. |

|

Prior certificates of title |

If a previous certificate of title holds priority it may affect the registered title. |

|

Prior registered interests |

A previously registered interest that was not properly removed or acknowledged may override the new registration. |

Among the exceptions above, fraud is the most prevalent exception to indefeasibility for lenders. It represents a key area of legal risk that lenders must be vigilant to mitigate when lending money in return for a right to register an interest on title. It is also important for lenders to be aware of the types of fraud that may be perpetrated by borrowers.

Elements of fraud

In the early twentieth century, it was established that fraud in this context requires actual or intentional dishonesty. The person whose registered title is being challenged must themselves be dishonest, or their agent must be. Dishonesty by others in the chain will not constitute fraud unless the proprietor or agent knew about the dishonesty. This was reinforced in 2021 by the NSW Court of Appeal in a case that reaffirmed a registered mortgagee’s title is indefeasible, even if the mortgage was obtained through fraud or forgery, provided the mortgagee was not a party to the fraud.

Hence, simply failing to inquire about suspicious documents or information does not automatically constitute fraud. However, there are other lines of authority to the effect that wilful blindness or voluntary ignorance can amount to fraud. If a lender suspects something is wrong, and deliberately avoids investigating further, then this may be treated as fraudulent conduct. It is therefore important that lenders exercise due diligence and awareness in all dealings.

A common scenario that requires mitigation is the dishonest attestation of a mortgagor’s signature on a document then provided to a mortgagee or his or her agent. If the mortgagor presents a document for registration that turns out to be forged or fraudulently obtained, the lender or their agent has not committed an act of fraud if they genuinely believed the document was legitimate and could be lawfully registered.

Consequences of fraud

When fraud results in the deprivation of a rightful interest in land, the defrauded party can seek rectification of the Register in the Supreme Court. In such proceedings, all parties with an interest in the relevant land will need to be joined which means such claims are often complicated and costly to be involved in. From a lender’s perspective, this will delay their ability to be repaid and release any relevant security (if indeed that proves possible).

Otherwise, a defrauded party may seek compensation from the Torrens Assurance Fund (Fund). The Fund compensates individuals who suffer loss due to fraud, errors, or omissions in the Register. However, compensation is not available if the loss arises from the defrauded party's own actions, negligence by their solicitor, or failure to mitigate the loss. Claims for compensation must be made to the Registrar General, and unresolved claims can be pursued in Court.

Fraud mitigation

Andrew Grima, a Partner in our Property team, recently explained in the Law Society Journal that the introduction of PEXA has reduced the instances of fraudsters obtaining the certificate of title to land and easily forging a signature on a transfer or other dealing. However, despite this reduction, there are a number of other practical measures lenders should adopt to mitigate the risk of fraud, such as:

-

Robust Internal Procedures: Implement clear procedures for verifying borrower and property information. Ensure identification is properly confirmed, including requesting certified copies of identification and other relevant documents.

-

Proper Execution of Documents: Ensure all documents are properly executed and attested by authorised parties to prevent the risk of forgery.

-

Title Insurance: This is a type of insurance that helps existing registered proprietors, property buyers and lenders avoid financial loss from problems with a property’s ownership history, e.g. fraud, mistakes in paperwork, or hidden claims.

-

Conducting Verification of Identity checks: As a part of identity verification protocols, individual borrowers and guarantors are typically required to present documents equating to 100 points of identification. In addition to this, they must capture a real-time photo and video of themselves. This dual process helps confirm that the identification documents genuinely belong to the person presenting them, thereby reducing the risk of impersonation or fraud in property and financial transactions.

-

Requesting rates notices: To ensure that a borrower has the legal authority to deal with a property as its registered proprietor, lenders may request council and water rates certificates covering the previous three months. These documents, typically provided by the individual or their solicitor, help verify the borrower’s ongoing connection to the property and confirm that they are maintaining responsibilities consistent with ownership. In our experience, urgency in property transactions often leads to critical fraud risks being improperly managed, particularly when that urgency lacks a clear or legitimate basis. These high-pressure scenarios are among the most likely to involve fraudulent activity. It is therefore essential that lenders institute and apply robust policies and procedures, even under time constraints, to avoid being exposed to or implicated in fraud.

If you consider your organisation could benefit from a review of their policies and procedures or you have inadvertently become embroiled in a potential fraud, please reach out to our specialist Finance and Banking team at Bartier Perry for expert assistance.

Authors: Gavin Stuart, Emma Boyce, Karunya Vetcha & Rezwan Attai

This publication is intended as a source of information only. No reader should act on any matter without first obtaining professional advice.